Staying Organized with Finances to Plan for a Flexible Future

While this may not be career advice, ZealAdvisory works with many clients who are starting their careers and may not have as much financial capital. As many are aware, the amount of money saved early on can have a profound impact on future financial freedom.

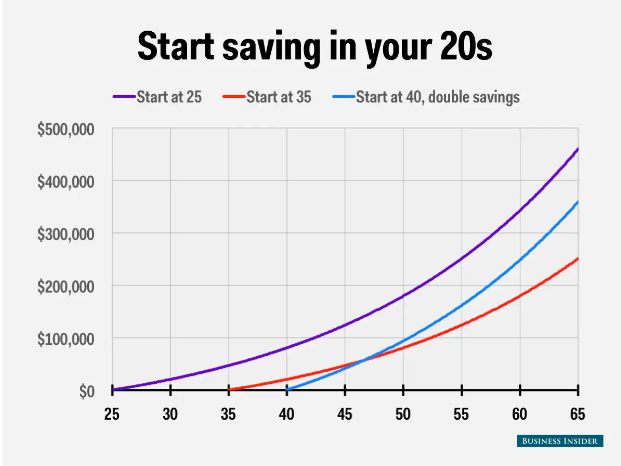

The following picture, which can be found in this article, outlines the importance of starting early.

Having more financial freedom and capital allows you to pursue higher-risk, higher-reward opportunities and can allow you to exercise freedom in making future decisions.

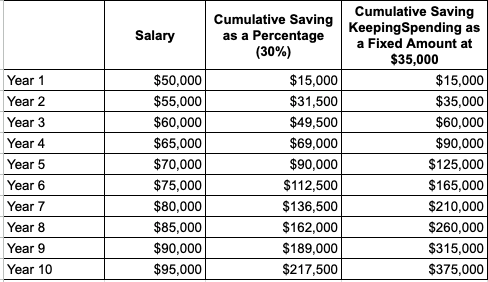

While saving money receives a lot of attention, I believe it’s more crucial to understand where your money is being spent. Unless you have a high income, it can be challenging to identify areas to cut back on spending. Controversial opinion I am a firm believer that saving should not be a percentage of your income, but rather, spending should be a fixed amount.

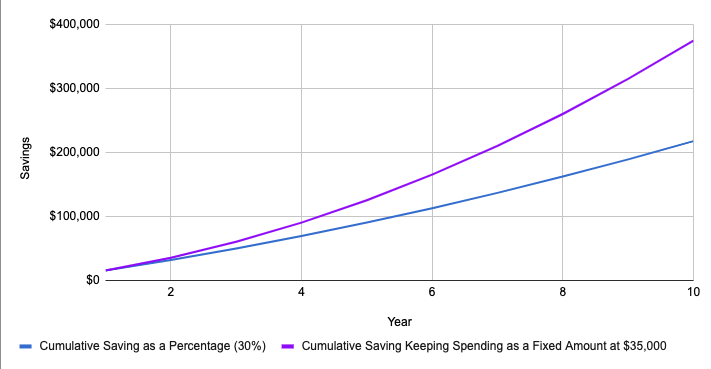

For most people, their salary will increase more than this over a 10-year period, and they will likely increase spending as they age and earn more money. This can serve as an illustrative example.

By keeping one’s spending the same, they can nearly double their savings over time. For most people, spending is a matter of habit. If you can get used to a certain spending threshold, you can easily double your savings over the next 10 years. If every time you get a raise, you keep your spending and savings as a percentage of your income, the amount you save will increase, but so will your spending, and you will get used to spending at that amount until your next raise, where there is a new normal.

Coupled with this, I find that all too often, people have no visibility on how much they are saving or spending in a given month, let alone a given year. I’ve put together the following budgeting tracker to help support your spend tracking. While many bank accounts provide budget tracking, they don’t account for:

Purchases made on your card that are being reimbursed by your employer.

Purchases made for a group of people with plans of reimbursement.

Ambiguities in categories; for instance, all Amazon purchases will count as shopping, but people use Amazon for clothes, groceries, furniture, etc.

The tracker I have created takes care of all these issues and allows you to quickly document your spending.

Steps to set up the tracker:

This tracker was set up for my spending buckets, but I highly recommend customizing the categories to fit your spending habits.

Apply the Categories fields to the drop-down on the Months tab.

Add to Google Drive to allow for easy editing

How to use this tracker:

Export your bank statements from any accounts used in a given month.

Include transactions from checking accounts, credit cards, Splitwise transactions, etc.

Copy and paste the values into the columns on the Month tab, ensuring that the item, amount, and dates are in the correct columns.

Update the Adjusted Amount field to account for expenses that you do not bear the full cost of or are split across multiple categories.

This ensures that your expense tracking is accurate and up-to-date. It may have been either fully reimbursed, such as via a refund, or someone else (like an employer) paid the full amount.

It may have been partially reimbursed, such as when you picked up the dinner tab, and your friends transferred you their portions. Items that fall into multiple categories, like taking a friend out to dinner, should have two line items: one marking your portion of the bill as a restaurant expense and the other portion marked as a gift.

Update the category fields to account for which group the expense belongs to and update the pie chart to see your monthly spending splits.

Copy all the data fields to the “All Results” tab. This allows you to use the Annual Charts tab, which includes a comparison of month-to-month spending and a pie chart to visualize total spending. Some people may opt to exclude rent and utilities; I include it and just hide the values from the charts.

For the next month, duplicate the tab, remove all data, and start again.

Once you have done this for a few months, you can have an accurate view of what you are spending on and where you can cut back. Many people are shocked by how much they are or are not spending in a certain category.

Now that you know how much your monthly spending is, set an amount that seems reasonable. I try to pay my credit card off on the first of every month so that I can track how much of my total spending budget I have spent as the month goes on. If a friend or company reimburses me for something, I will proactively pay off my credit card, so that number serves as an accurate measure of my monthly spending.

If I go over, I log that number on the Overspending tab, and I know that I need to “pay myself back.” For months where I go under, I subtract that from the overspending tab. I try to ensure that I pay down my overspending tab by the end of the year.

Additionally, I try to keep track of my net worth. At the end of the year, I calculate my total net worth using the Net Worth tab. You can add and remove rows based on how you save money. This can help you keep track of how much you are saving over time. You don’t need a reason to save; saving gives you future financial autonomy and freedom.